NextGen

Trading Platform

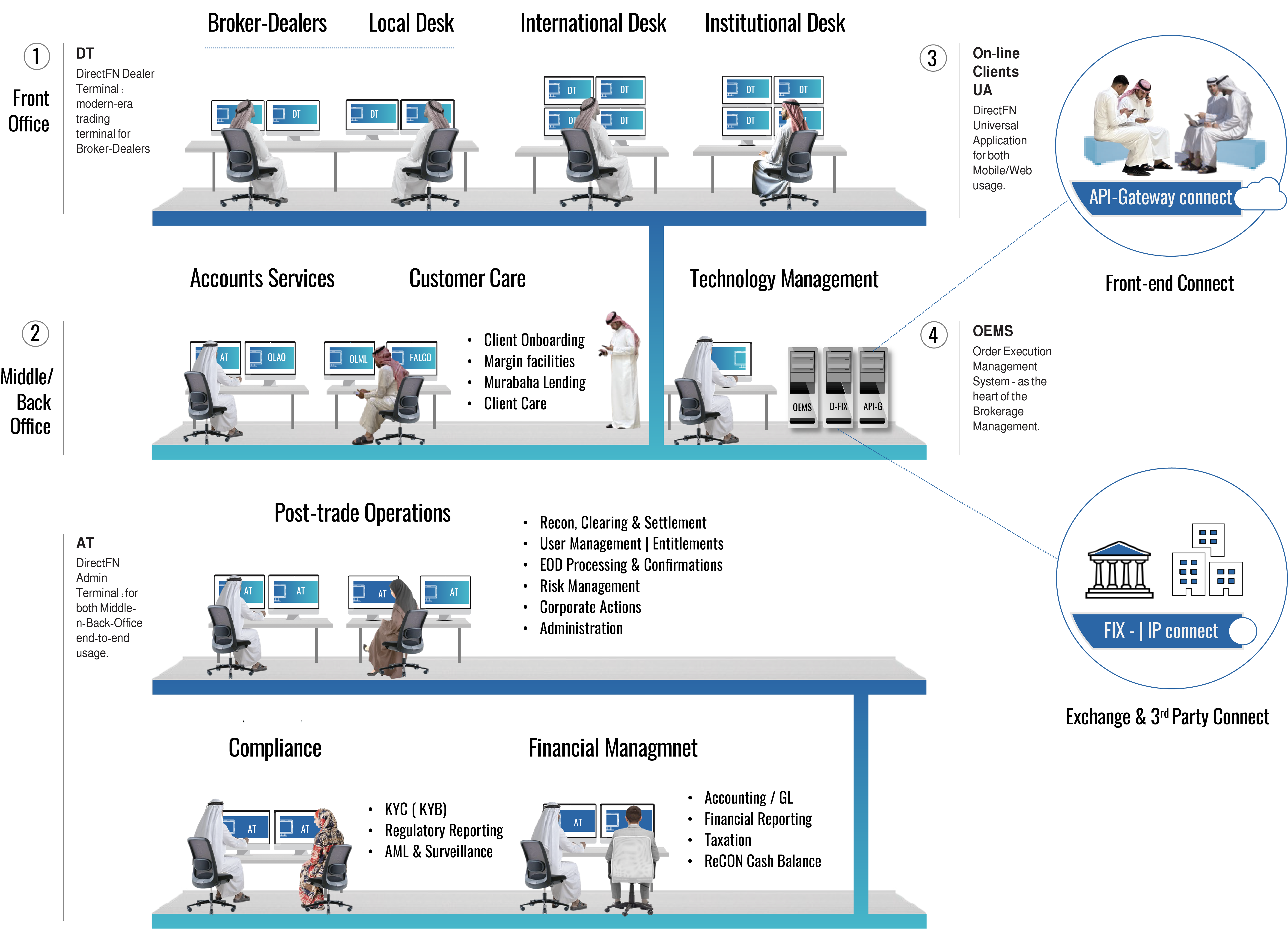

1. Modern-era Tech Architecture

NTP was developed and matured within the last 5 years. Unlike other solutions that need constant updates, NTP is inherently modern, meeting current demands and ensuring long-term superiority, thus reducing upgrade cost.

2. Regional Relevance

NTP, a home-grown solution for Saudi's CMI hub, thrives in the dynamic environment of the world's 9th largest exchange. NTP stands out with its robust coverage of regional regulations and diverse instruments, perfectly tailored for today's market and future growth.

Technological Foundation

End-to-end Functional Coverage

AMS

One-Stop

Solution for all the Back office Middle Office, and Front Office needs of an Asset Management Company

i. One-Stop Solution

DFN-AMS integrates multiple modules for a seamless asset management solution. Uniquely, its modules are co-developed to work together or independently.

ii. Broad Coverage

The asset management industry relies heavily on the ability to offer a wide range of products with an available set of instruments. DFN-AMS through its smart Backoffice provides the necessary tools to design Funds having intricate underlying mechanisms while the Front office is there to enhance the investment horizons for the Fund Management Desk

iii. Operational Automation

Operational activities are at the heart of any AMC business. The success of any AMC relies heavily on the precision, accuracy, and timely execution of its operational activities. DFN-AMS Backoffice with its built-in Accounting, Portfolio Management, Unit Registry, and reporting provides end-to-end automation of processes, minimizing human interference thus maximizing the precision, accuracy, and timely execution of the key activities.

Custody

Management System

i. Tech Alignment

DFN-CMS is designed primarily for the Saudi and regional markets, with a clear vision to align with tech and procedural enhancements that arise because of regulatory standardizations. The outcome is a product achieving tech superiority through inherently scalable architecture with efficient business processes to cater to internationally accepted protocols like ISO.

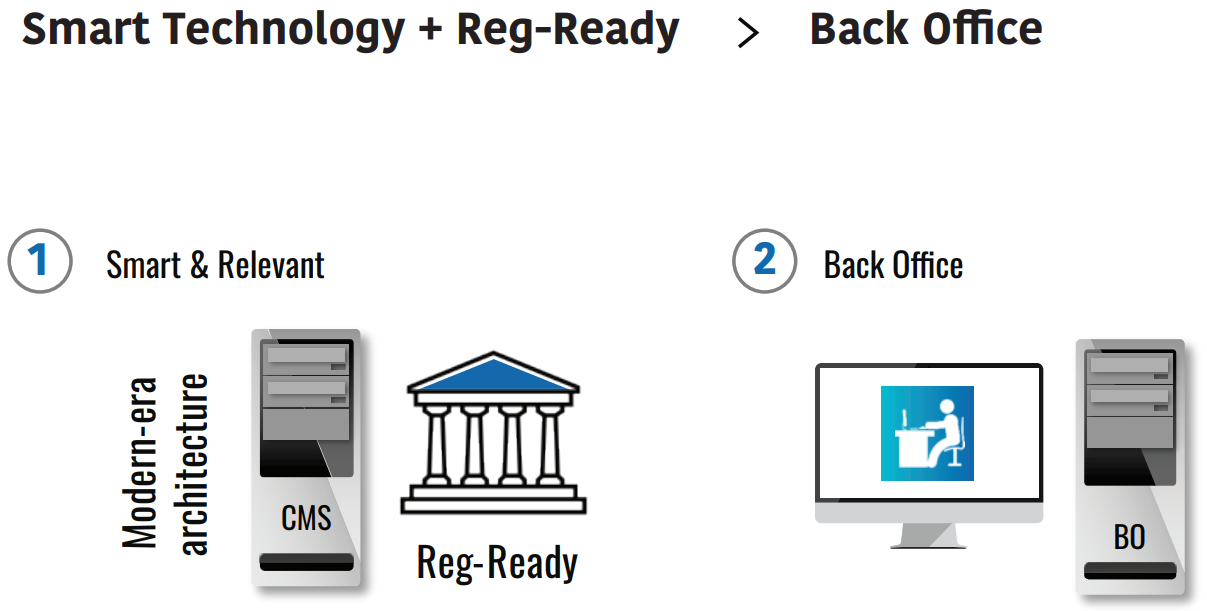

ii. BackOffice Ready

Apart from specific KSA ISO implementation, a version of DFN-CMS also offers complete Backoffice functionalities for custody operations. This covers everything from multi-asset class trade processing to SWIFT integration for global parties.

Industry relevant features & functions

Clearing

Management Solution

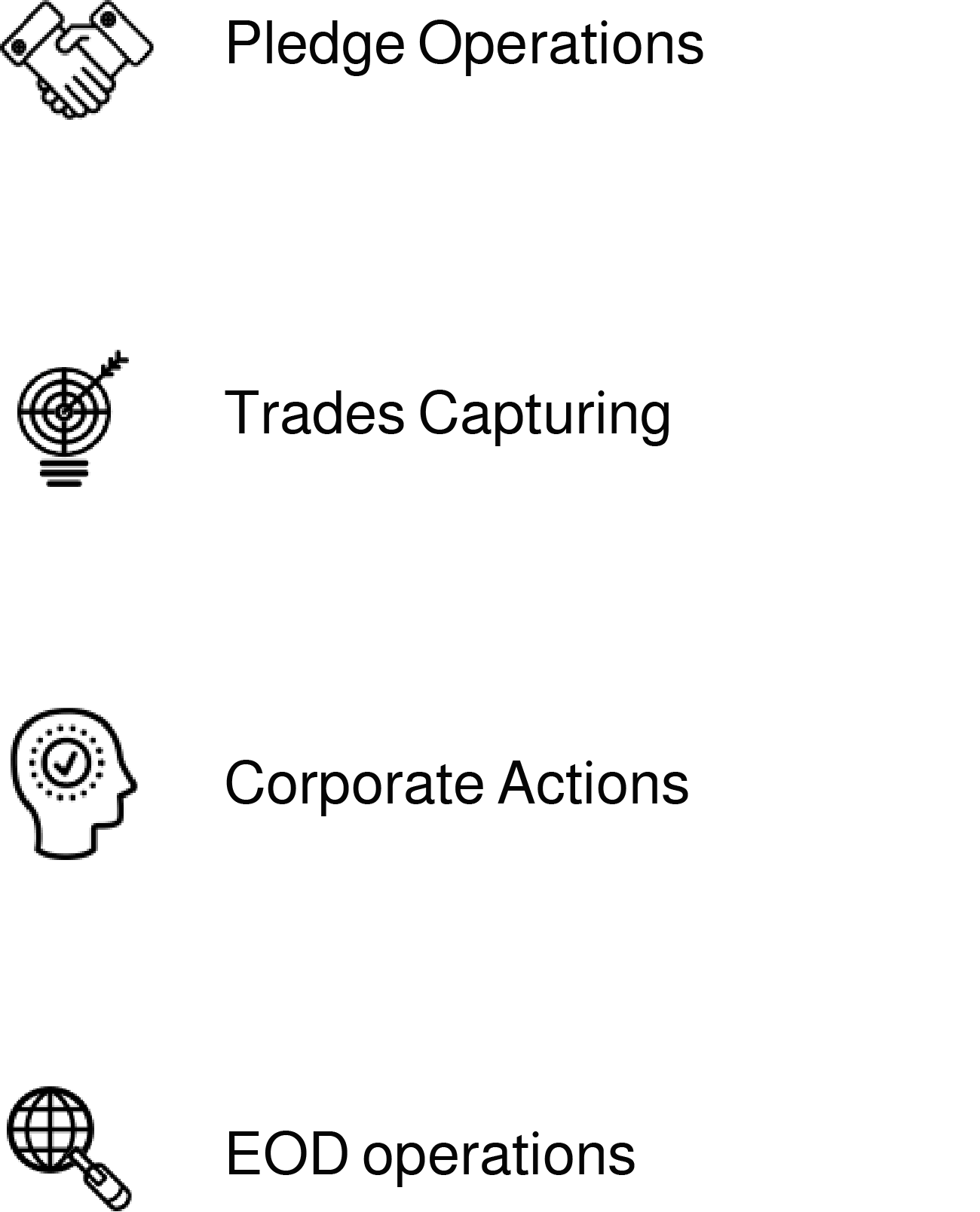

i. UP & Downstream Integrations

Any clearing system is as good as its capacity to consume and disseminate data. The DFN Clearing system, with its FIXML engine, consumes data from CCP while maintaining Queues to integrate seamlessly with core banking, resulting in automating end-to-end processes.

ii. Risk Mitigation

Timely and accurate margin calculation with collateral submission is at the heart of a clearing system. DFN Clearing System, on a real-time basis, takes all underlying open positions, calculates the margin requirements with additional coverage (if required), and raises collateral calls all in one go.

iii. Accessibility

To extend the reach and provide more transparency, web-based access is available for the Non-Clearing Members (NCM). NCMs can log in to the application and can monitor their collateral, margin, and exposure details. Furthermore, they can even generate requests for excess cash collateral as well.

Funds

Distribution Platform

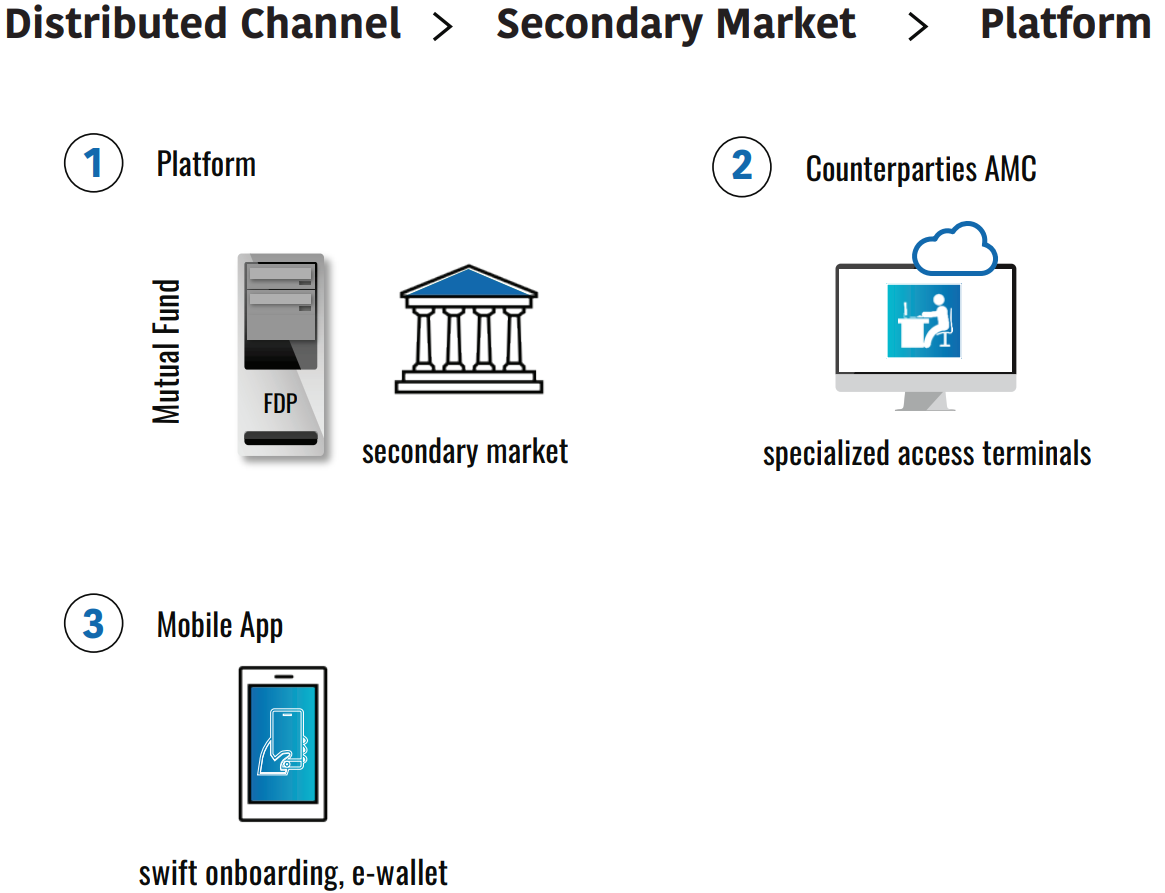

i. Enabling a Secondary Market

The design of the DFN FDP fully supports enabling a secondary market for an instrument like Mutual Fund (specifically Close-ended). This alone is a powerful tool for entities like Exchange to extend their offerings while increasing the liquidity in the market.

ii. Customer Centricity

FDP is developed as a platform with a client-centric approach. Therefore, the outcome is a solution that enables the customer to have swift onboarding, have their e-wallet, and perform transactions through any channel with ease.

iii. Counter-Party Access

Counter-party access is an important aspect not only for monitoring purposes but especially for instruments like open-ended funds where STP is sometimes not possible. DFN-FDP system comes with specialized access terminals for counterparties like AMC where they can perform activities to execute transactions.

Industry relevant features & functions

Market

Making System

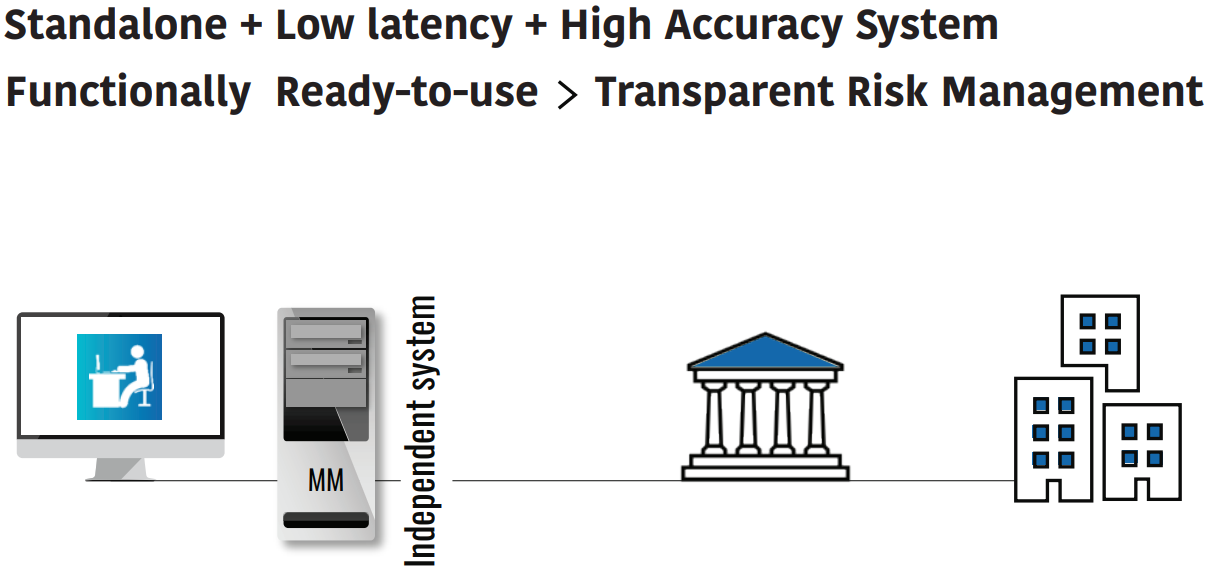

i. Standalone System

DFN-MM System is a solution designed to be independent of technological constraints using industry-standard protocols. “High throughput with low footprint” is the methodology behind the design, resulting in an easy-to-maintain, highly efficient system that can be integrated with any OMS.

ii. High Accuracy-Low Latency

Market Making is all about precision with speed. As a participant, the key objective of a Market maker is to provide liquidity with a positive P&L at the end. With the DFN-MM system, liquidity generation is accomplished by ensuring maximum availability in the market while gains are collected through dynamic strategies based on available spreads.

iii. Operational benefits

DirectFN with its unique positioning as a Tech and Content provider, gives a clear edge in providing real-time accurate decision-making. DFN MM system with its built-in compliance, powered through real-time data and presented via user-friendly dashboards, makes it an ideal system for both the MM users and risk & compliance.

Market Making features & functions

DirectFN Ltd.

[Direct Financial Network Company]

DirectFN (c) 2024